How to pay tax in the US (if you’re British). Part Two, the W8-BEN

So, it’s three to four months after you sent off the W7, and you have a nice letter from the US government with your ITIN. If you haven’t received it within 120 days, give the embassy a call. If you filled in the W7 as common sense suggested, rather than the previous post, it may have been rejected. Sorry.

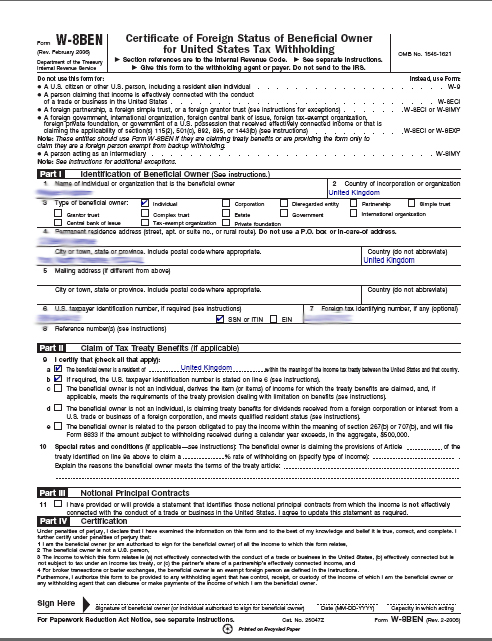

Anyway, your ITIN comes in the post. Now it’s time for the next form, the W8-BEN. Ben is an annoying form, because the instructions are even less comprehensible than the W7’s.

As before, personal details smudged out. The first few sections are straight forward, with names and addresses. You’re an Individual, if you were wondering, unless you’re publishing as part of your own business. Can’t help you with that, I’m afraid.

Ignore “8 reference number(s)” unless you have something prearranged with your publisher.

For part II, tick A and B. Ignore Part III. Like the reference numbers, you’ll probably only know what it means if it applies to you. Sign, date, and send out! I sent out paper copies, though most publishers are happy to accept email. Adobe Acrobat decided I wasn’t allowed to use an electronic signature, though, so print was easier for me.