How to pay tax in the US (if you’re British). Part One, the W7

Since I’ve had to go through all this, I thought it might be worth sharing. I suspect it’s a similar process for any country that has a tax treaty with the US, not just the UK, though I’m afraid you’re on your own if your country doesn’t.

So, you’ve been accepted by an American publisher. Brilliant! You, my friend, are made of awesome. And to make sure the US government doesn’t take 30% of that awesome off you, you need to fill in some tax forms.

Firstly, you need to contact your publisher and request a letter explaining to the IRS why you need an ITIN. Unfortunately, your contract isn’t sufficient evidence. Most publishers are used to dealing with this (and if you request letters from more than one publisher, you’ll notice they’re pretty similar). From personal experience, it tends to be a physical document rather than electronic. I’m not sure the IRS wold accept an electronic signature.

So, you twiddle your thumbs for a couple of weeks, and your letter arrives. Brilliant. Time for step two.

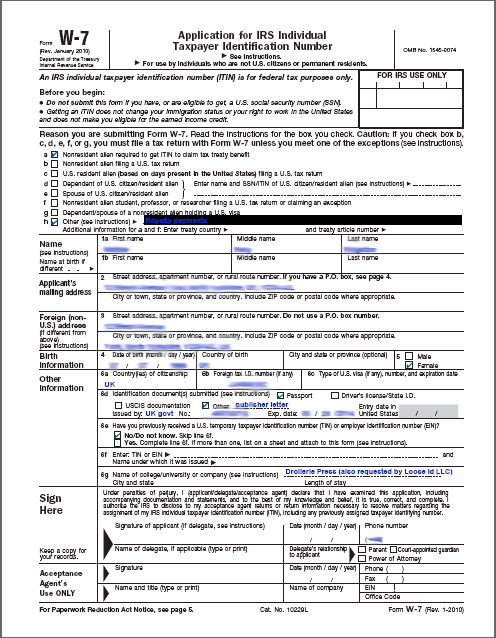

Download form W7 from the IRS website. You may also want to download the instructions, though they’re of mixed use to an author.

Yes, that is my form, with all my personal details scrubbed out. Well, apart from the fact I live in the UK, and I’m a girl. I figured you already knew that. The impersonal details, which are still just about visible if you click the thumbnail (sorry, this was a matter of PrtSc and pasting into Photoshop!) are the important ones.

Firstly, if you live in the UK, we have a tax treaty with the US. You are submitting the form for reason A. Tick box.

Secondly, you are submitting the form for another reason, one the US government doesn’t feel fit to make a special ticky box for, so tick box H. Now, I just wrote ‘Royalty Payments‘ on the dotted line, as you can see, but if you want to make your form look really professional (thanks to Neil McKenn’s helpful, if hard to find, article over at the Andrew Lownie agency), you can try writing ‘Exception 1‘. Next to Treaty Country write ‘United Kingdom‘ and next to Treaty Article Number ‘Article 12 – Book Royalties‘.

So, that’s one (or more) letter from your publisher, and a completed W7. You also need some ID. Passport, birth certificate or driver’s license for preference. Since I still get carded occasionally (yay me, I suppose) and I haven’t seen my birth certificate in some years now, I went for my passport. Besides, I wasn’t sure if a seven year old provisional driving license would pass muster.

Now, if you live in London, or have a nicely flexible schedule and fancy a day out in our fair capital, you can go down to the IRS office in person and hand over the form. Celia and John (having followed Neil McKenna’s advice) go into that option, but since I worked a 9 to 5 a two hour train journey from London, my options were to take time off or to post it. I didn’t fancy a day trip, so to the post office I went.

Internal Revenue Service

American Embassy

24 Grosvenor Square

London W1A 1AE

Big tip: send it recorded delivery. That’s your passport in there. Don’t worry, they send it back promptly, and if you’re lucky the same way. I got mine back within a week, along with a very polite note explaining I’d forgotten to sign the form, and could I do so and post it back ASAP. Whoops. Didn’t need to send anything back apart from the form, I hasten to add. My passport was mine again (now, if only I could remember where I put it after that…)

So, that was that, for now. Time to sit on my hands and wait. Or get on with editing. You know. Author stuff.